FINANCIAL LITERACY- TEACHING KIDS THE ART OF SAVING.

Change is the only constant thing in this world. Over the years, we have been evolving physically and cognitively. Our society has also evolved. The human brain has evolved over hundreds and hundreds of years with the aim of survival. As we evolve, we are challenging our brains to do things that it is not designed to. Over the centuries, we are pushing our brains to do what it was simply not designed to do. Changes in the economic structures globally and the metamorphosis of the financial landscape over the past couple of decades have taxed our cognitive capabilities to new levels. Financial capability is a skill which has come of age. Mindsets are shaped at school and therefore including financial literacy at school level is a good way to ensure that the future citizens are exposed adequately to the world of financial planning.

The need to gear up the children of the 21st century with financial literacy and giving them an exposure to wealth management is a lot more than we ever needed. Think about it, had you not committed terrible money blunders when you first started off as a working professional? Should we allow our children to repeat our mistakes? Of course, they can make mistakes but to rectify and solve those errors they need financial tools and a comprehensive understanding of the same. Today’s millennials face an overwhelming number of complex financial decisions.

We, at PICT, believe that it is extremely important to impart financial literacy among students at an early age. Learners are engaged in activities that help them to understand out the difference between needs and wants, necessity and luxury. Making their own income/savings and expenditure plans, spending plans, planning weekly and monthly budgets are a few of the skills that they are initiated into. Saving for a rainy day, experiencing the joy in charity is imbibed through our financial literacy sessions. We encourage students to come up with their personal finance plans and handle their own spendings and savings. We also talk about cyber crimes with an aim to educate students against malicious online practices and to spread awareness about taking care of their money.

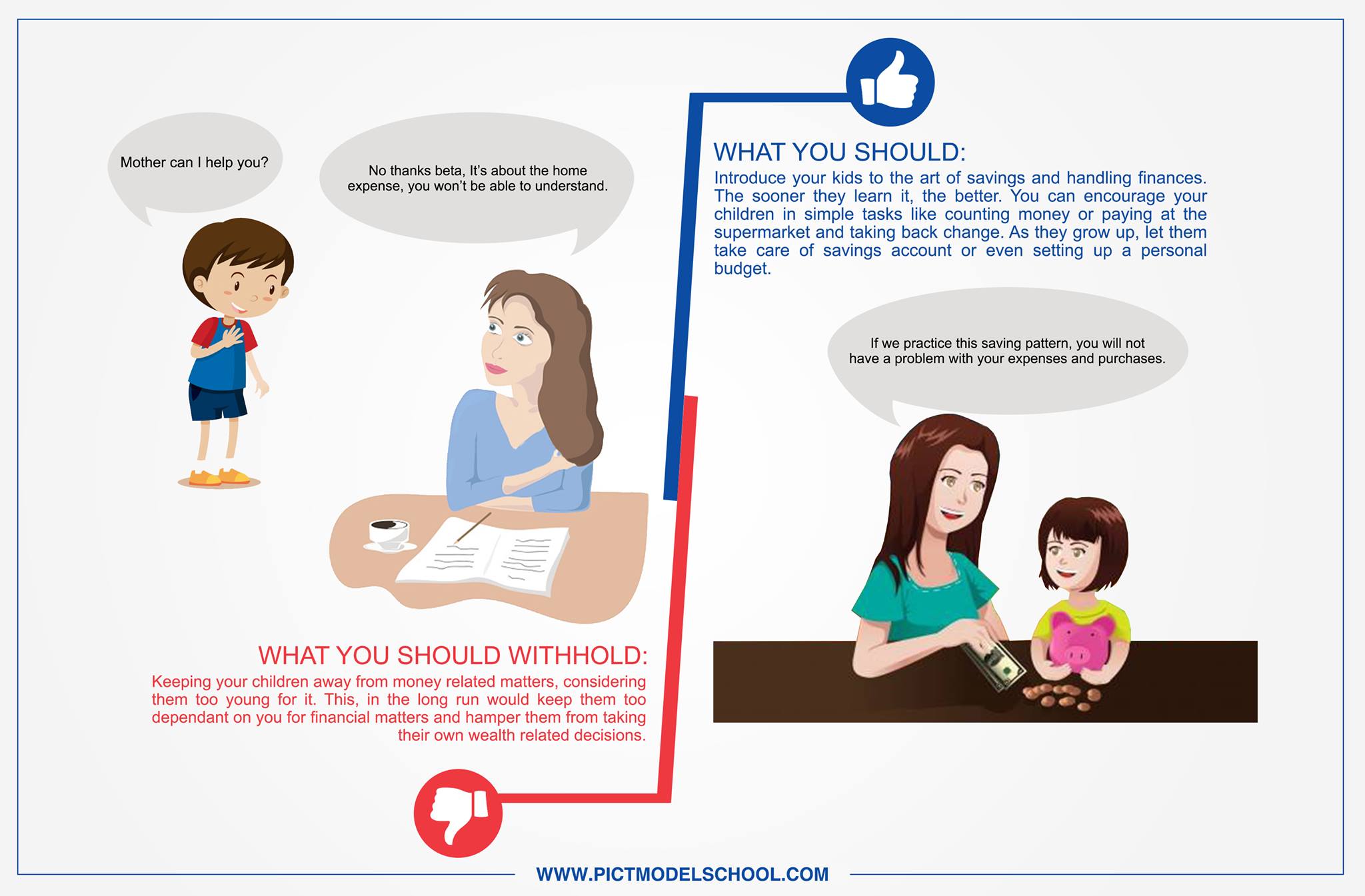

How can you include financial lessons at home?

By initiating your children into world of money, you help them discover the relationships of earning to spending and saving. In doing this, children begin to understand the value of money. This financial literacy can begin at a young age with simple money concepts such as counting coins and making change for purchases. Older children can learn about savings accounts, balancing a checkbook and creating a personal budget. As in all other skills, financial literacy is a skill which is painstakingly inculcated, developed and nurtured over the years. Children have to experience the process. Empowering children with pocket money and taking them through the process of maintaining a spending plan to teaching them the art of budgeting are the first steps to making them financially literate. One step at a time will help them climb up the financial ladder with confidence in the years to come.